Cheap Money Transfer from Singapore to Malaysia with Wise

This article will share how I cheaply transfer money abroad using an app & website called Wise (formerly TransferWise).

Here are some scenarios where you might want to transfer or receive money abroad. I will be using examples for Malaysia throughout this article:

| From Your Country to Overseas | From Overseas to Your Country |

| Sending money to family members who are living overseas | If you work overseas and want to send money home |

| If you work in a different country and would like to send money back home | – |

Traditionally, the most convenient way to do this was to use TT transfer using our banks, which costs a lot in fees (cable charges, plus their commission).

The next best way is to use Western Union (I’ve never used it though), which if I’m honest, is notorious for online scams.

Now, we have a money transfer app called Wise that gives us transparency, low transfer fees, and the convenience of not having to go to the bank or money changers physically.

What is Wise (Formerly Transferwise)?

You can think of it as an online money transfer that has one of the best exchange rates compared to bank TT and traditional money changers.

Wise is a UK company that has been in business since 2011. It is regulated by Bank Negara and has the appropriate remittance license.

I have personally experienced receiving Euros from France (EUR to MYR) and sent over Singapore Dollars back home (SGD to MYR).

How Does Wise Work?

In this example, I will show you how I transferred SGD 100 from my Singapore Bank account to my Malaysian bank account using Wise:

Select Currency

In this example, I am transferring SGD to my MYR bank account

Pay to Wise SG

I’ll transfer the agreed amount to Wise’s local SGD account

Verify Payment

Wise will take around 1 day to verify your funds

Get Paid Wise MY

I’ll get paid in MYR from Wise Malaysia account

I will typically get paid from 1 to 3 business days from the day they verify my payment.

Notice: Wise has bank accounts in all countries that they operate. The money doesn’t move. I pay to Wise’s SGD bank account, and they will transfer me the agreed MYR equivalent from their MYR bank account.

Step-By-Step Transfer Guide:

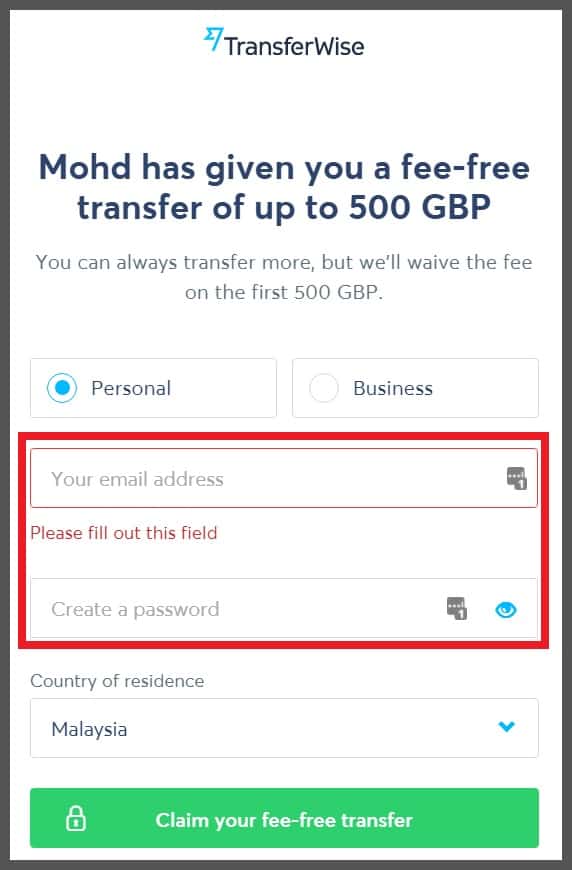

STEP 1: Register an account with Wise through my link, and you’ll get your first transfer free up to £500 (MYR 2,500):

STEP 2: Once signed up, click on ‘Send Money‘:

STEP 3: Select the sender currency. In this example, I want to send SGD to MYR. So I need to set the currencies to:

- Sender currency to SGD

- Recepient currency to MYR

STEP 4 – Changing the Sender’s Currency from USD to SGD: Find & select “SGD” from the drop-down menu:

STEP 5: Previewing the Fees. All fees are out in the open & transparent. It will show:

- The total transfer fee

- The conversion rate for that day and is guaranteed for 48 hours.

- The total MYR that I’ll be receiving on the other end:

STEP 6: Before I hit that ‘continue’ button, let’s compare Wise’s rate with Google’s conversion rate for SGD 100:

Google’s rate: I’m supposed to be getting RM 306.52, but I’ll only be getting RM 302.60 using Wise. The transfer cost is RM 306.52 – 302.60 = RM 3.92. I think this is an excellent conversion rate! I’m happy, so I click on the ‘continue button.‘

STEP 7: On the next page, select who’s going to receive the money. This is not my first time, so I have my recipient info already there.

But if you’re new, you need to click on ‘New recipient‘:

STEP 8: Fill out the recipient’s bank info:

STEP 10: Answer why you’re transferring the money. Don’t worry. You don’t have to be too honest here. I don’t think it matters:

STEP 11: The final step is to review everything:

- Make sure the amount tallies up with the earlier quote.

- The recipient’s details are correct.

- You can type in any reference if you want.

Click on ‘Confirm and continue‘ once everything is in order:

STEP 12: Select how are you going to pay Wise that SGD 100. As can be seen in my options, the cheapest is to use a bank transfer.

If you don’t have a Singapore bank account, you have to use other methods that will costs you more in fees.

Select your payment method and hit ‘continue to payment‘:

STEP 13: Transfer the agreed SGD amount to Wise’s Sg account as instructed. You have up to 48 hours and during this timeframe, they will honor their quoted transfer fee.

Wise’s Singapore Bank account details show up in the next window. Make sure to include the reference code, so Wise can verify that your funds is from you.

Once I’ve made the transfer, click on the ‘I’ve made my bank transfer‘ button and give them 1 to 2 business days to verify that they’ve received the money:

A few hours later, Wise confirmed receiving my SGD 100, and I got an email saying that my MYR is on its way:

A day later, the said money is indeed in my bank account:

That’s it. Very easy and transparent, every step of the way! 🙂

Key Takeaway – My Verdict

So far, I’ve used Wise exclusively to transfer my money from Singapore to Malaysia. Here’s what I love about Wise:

- I love the transparency of the fees and conversion rates.

- Their app and website are really easy to use.

- It’s quick. I get my money within 3 days usually.

- They alert me via email every step of the money transfer process.

Start Transferring Money

Is this useful? Click on the button below to register your account with Wise & start transferring money for less:

Alternatively, if you find this post helpful, you can use my referral link and you’ll get your first transfer up to GBP 500 fee waived.

Im Malaysian student staying in UK. So in the “country of residence” should be Malaysia or UK when I register my account?

Honestly, I don’t think it really matters, just pick whichever country that you’re currently living in

Hi .. I have made foreign transfer payment to publish my articles and although I already knew about Wise, I am very sceptical of actually using it. Thanks for your post, I decided to try out Wise to make foreign transfer to Europe. If everything goes smoothly, it will definitely optimize my future foreign transactions.

I have created my account in Wise and at verification phase it asks for National ID and selfie.. can you share your experience?

Thanks

I send in my ID for their verification. I think in today’s world, any financial-related app will ask you to upload ID for verification. I understand your concerns. I am sharing my experience. But ultimately, only go through if you feel comfortable.

Thank you for your kind reply. I appreciate this.

Glad it was helpful 🙂

Hi Helmi,

Thanks for the informative article and video 🙂

What puzzles me is that I’m unable to receive money from Australia (I’m based in Malaysia, with a Malaysian bank account). And I was told by Wise customer service is that “At the moment, we don’t offer bank details in Malaysia to receive money into your Wise account, just yet”

That’s very odd. It seems I can select to transfer money from AUD to MYR on my end.