How to Renew Your Malaysian Car Insurance Online & Extra Coverages I Pay For

There’s more to owning a car than your monthly bank repayments. Road tax & insurance is one of those things most people push aside from their budget but can financially sting you when it’s time for renewal.

Some insurance companies can bundle insurance together with the road tax renewal. But for most, you’ll have to get them separately. In Malaysia, you’d have to renew your car insurance first, followed by the road tax.

In this article, I’ll share how I renew my car insurance online for my 4-year-old Perodua Myvi.

Note: Insurance renewal will depend on the value of your car. The more expensive it is, the more you have to pay to insure it.

Comparing Malaysian Car Insurance Online

The table below compiles some popular car insurers in Malaysia:

| Website & Link | Type | Can Renew Road Tax Together? |

| Loanstreet | Comparison website | Optional yes |

| Policy Street | Comparison website | Optional yes |

| AXA Insurance | Insurance company | No |

| Etiqa Insurance | Insurance company | No |

Picking a car insurer can be tricky. Have you ever wondered:

- Which brand is OK?

- How much to insure my car?

- Which add-on protection do I need?

I am no insurance expert, but I’ll share my thought process comparing car insurance & the optional coverage that I pick.

What I Look for in a Car Insurance

- Must be from a well known insurance brand.

- Need to be priced competitively amongst the market.

- Add-On: Coverage in the event of flood & windshield damage.

- Add-On: Windshield damage.

- Easy to use website.

Due to frequent flash floods in Malaysia, I highly recommend all Malaysians purchase flood insurance, no matter where they live. A flood-damaged car will be expensive to repair, if repairable at all:

Recommended: Flood Coverage

Recommended: Windshield Coverage

Windshield damage occurs more often than you think. I’ve cracked my Honda Civic’s windscreen at least twice within my 5-year ownership. I highly recommend you get this coverage. Most of the time, it’s due to rocks flying off the back of trucks on the highway:

Choose a Brand You Trust

I highly recommend you pick a brand that you know & trust. Note that a trusted brand will be different from person to person.

For example, I choose Etiqa as I’ve been a Maybank customer for years.

I find their website easy to navigate & their prices competitive with the coverage that I want. They made my purchasing decision easy.

I do not endorse Etiqa’s products. Whichever insurance you choose, the process will be similar. Do your research and pick suitable insurance for you & your car.

In the next section, I will show you my step-by-step process to renew my car insurance with Etiqa:

How to Renew Car Insurance Online with Etiqa

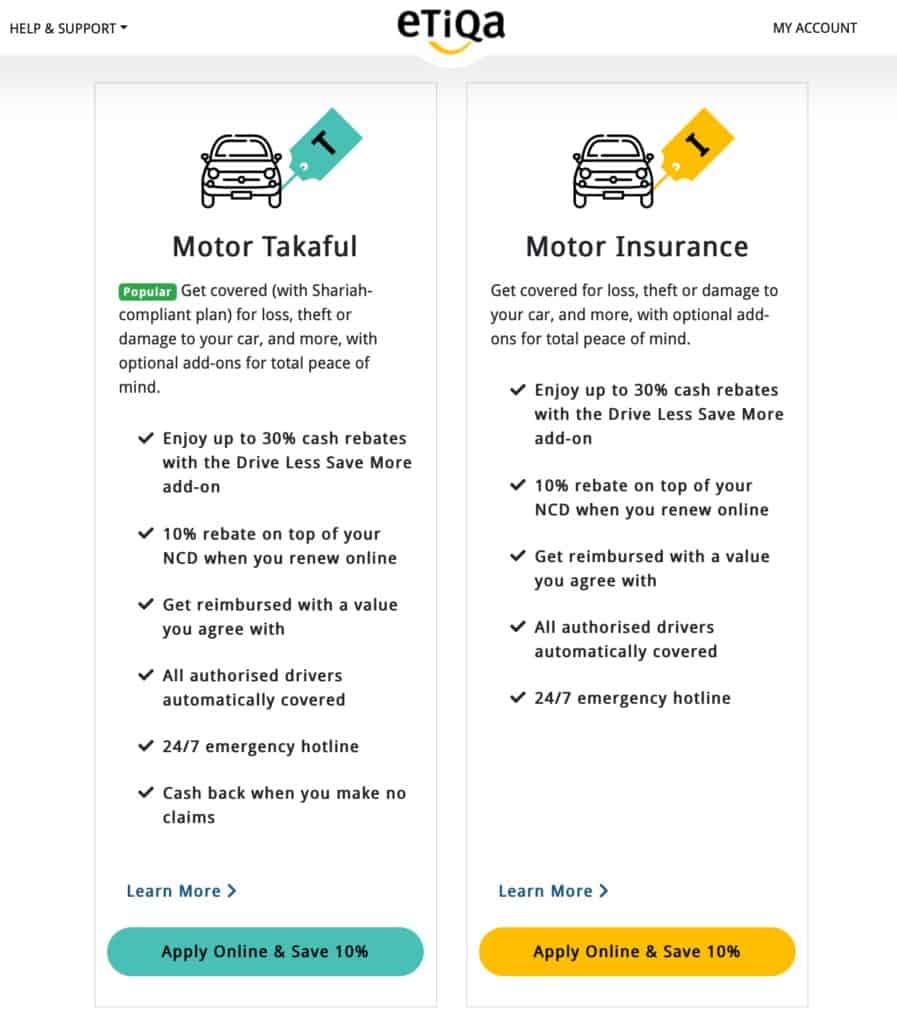

On Etiqa’s website, go to the car insurance section. There will be 2 choices:

- The conventional (regular) motor insurance

- The Takaful motor insurance (Islamic)

In short, Takaful companies only invest the collections in Syariah compliant investments. Besides that, Takaful & conventional work the same for the person purchasing it.

Ringgit Plus

I don’t care about either Takaful or conventional, but I chose Takaful anyway because there is a cashback benefit:

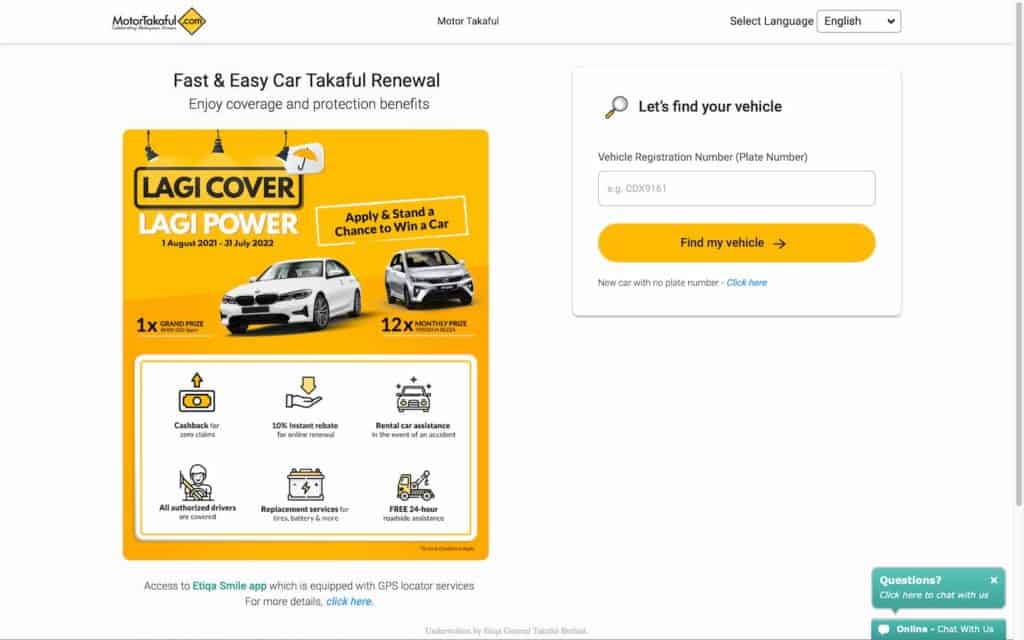

In the next section, type in your car’s plate registration number & hit ‘Find my vehicle‘:

If your car insurance is due for a renewal, Etiqa will show you the summary of their quotation on the right side of that table:

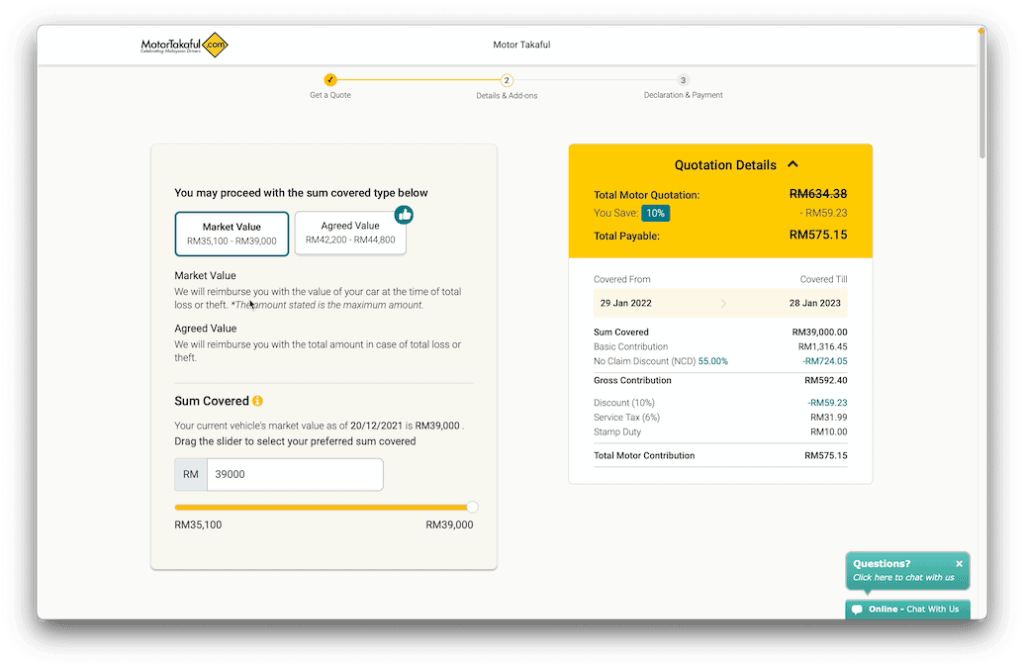

Here are my explanations for the quotation details in layman terms:

Understanding Car Insurance Lingo

| Insurance Lingo | Definition |

| Sum Covered | Max amount insurance coverage in the event of total loss. |

| Basic Contribution | The insurance quotation for a year’s coverage without NCD. |

| NCD | No Claim Discount: Max is 55% after 5 years without any claims. More info here. |

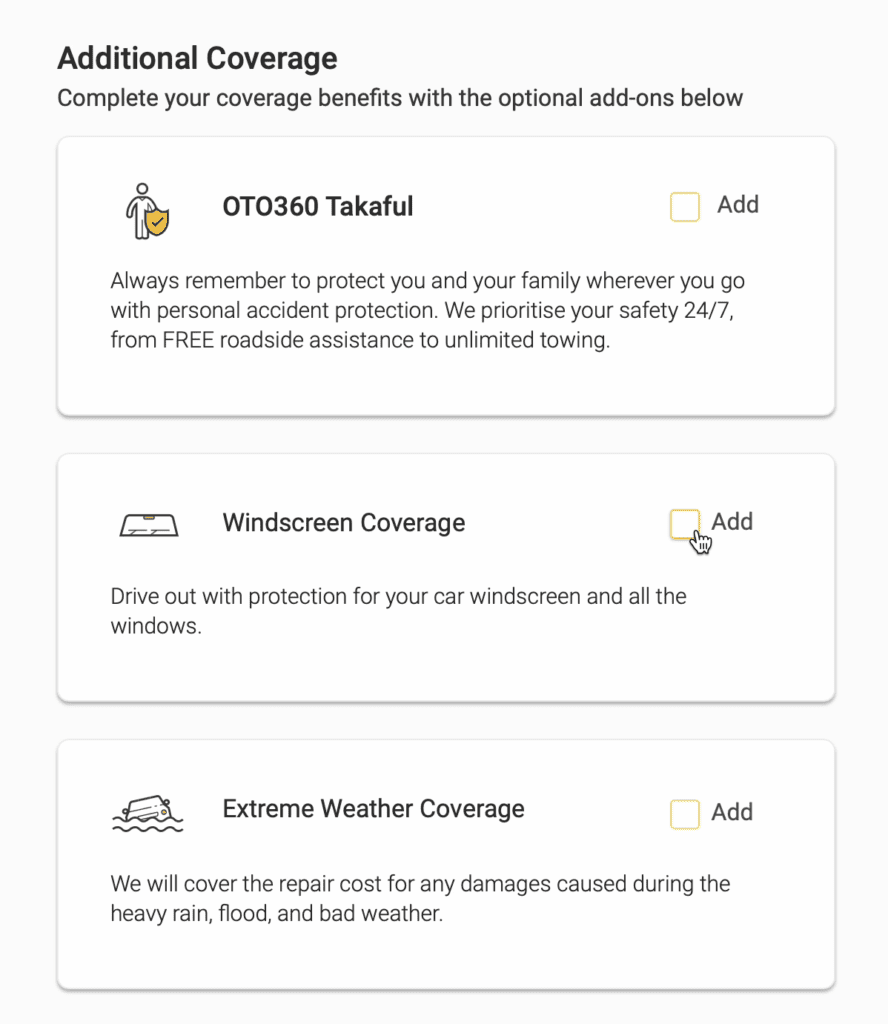

The left side of the quotation will show optional coverages that you can purchase:

I find most of the additional coverage necessary. But I usually add on 2 additional coverages as explained above:

- Windscreen coverage: +RM75

- Extreme weather coverage (floods): +RM96.53

Next, click on pay now & complete the payment. That’s pretty much it! You’ll receive an email for your coverage policy & also a physical copy of it sent via snail mail.

Cashback Tip: You can pay using a credit card that gives cashback like the Maybank 2 cards.

To view your insurance options again, click on the button below to jump back up to the insurance table:

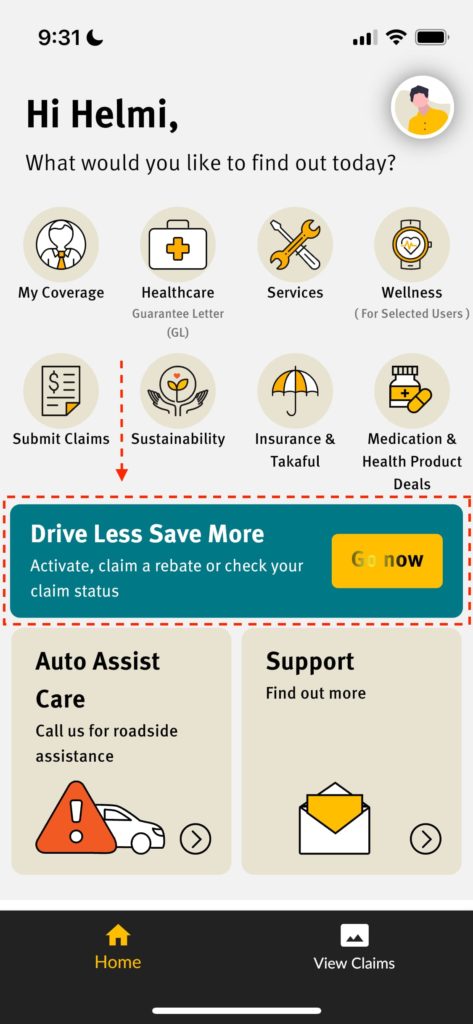

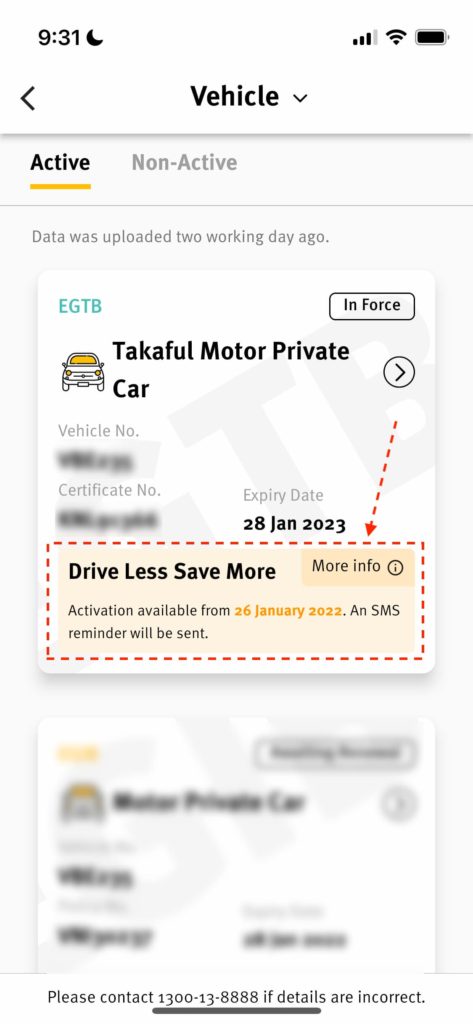

Drive Less, Save More Refund

This cashback feature is applicable for Etiqa Takaful motor insurance only. To get back that claim, I had to follow their rules:

- I had to download their Etiqa Smile app.

- I had to wait a few weeks after I purchased the insurance to start processing for that cashback.

At the time of this writing, I have not passed the activation date yet. I will update this article once I have started that process.

One Comment