Covid-19, Movement Control Order (MCO) & the Effects on the Malaysian Economy

The Covid-19 virus pandemic is running rampant all over the world. Malaysia is handling the virus situation well but it is hurting our economy dearly.

Implementation of Movement Control Order (MCO)

As of this writing, Malaysia has recorded 2,320 positive cases of the Covid-19 virus.

Due to the highly contagious nature of this virus, the Malaysian government made an early decision to edict the Movement Control Order (MCO) initially for 2 weeks from 18 March to 31st March. FAQ.

Under MCO, everyone is ordered to simply stay at home. They can only go out alone for emergencies and to buy groceries nearby their homes.

Considering that Malaysia is quite big, the army is deployed to help the police enforce the nationwide MCO with roadblocks and patrols:

.jpg)

Most people think they are on home holiday, but the reality is that the restricted movement is devastating to our economy:

How Covid-19 & the MCO Affects the Malaysian Economy

With the closure of roads, shops, transportations, and people’s fear of going out, a lot of businesses are suffering from little to no sales.

This is forcing a lot of businesses to drastically reduce their overheads to stay afloat.

When Malaysians are not moving, here’s what happens:

Malaysians Stop Spending

With everybody stuck at home and only spending on necessities such as groceries and take-out deliveries, other businesses not related to the essentials are suffering.

It’s surprising to realize that the economy crumbles when people simply stop moving and spending. Look how empty one of the busiest streets in KL is in Bukit Bintang during the MCO:

Businesses that are hit the most with the MCO:

- Tourism: hotels are empty and flights are mostly grounded

- Events: All events & mass gatherings are canceled and all the chain of services related to it (catering, travel & accommodation)

- Restaurants & Retails: no customers = no sales

- Manufacturing: Workers are not allowed to work and maybe no buyer for the products anyway

To make matters worst, some Malaysians are already being laid off as companies foresee this pandemic to span out for a couple of months.

When people lose their job, they’ll also lose their income and spending power.

Your spending is someone else’s income. When people stop spending, someone else out there will make less income and spark a chain reaction throughout the population.

The sudden stop of the economy is not only hitting Malaysia hard but the whole world with a recession in 2020.

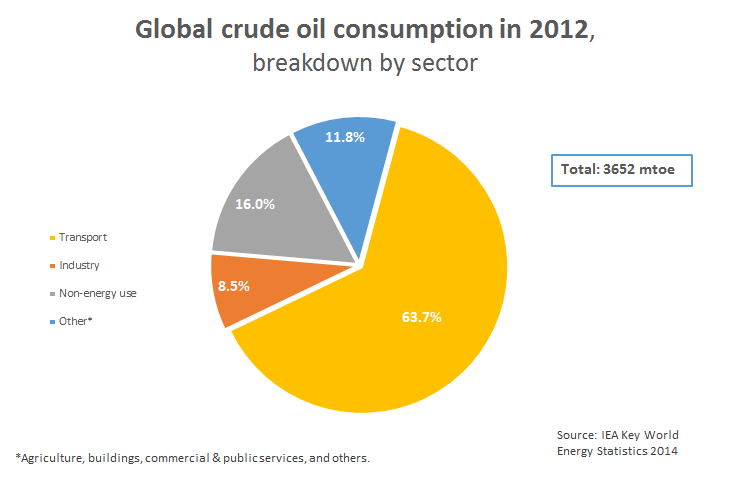

Low Demand for Oil Globally

On the 8th of March 2020, the 2 biggest oil producers (Russia & Saudi Arabia) were already at a price war triggering the fall of crude oil prices.

To top things off, with global travel restrictions due to Covid-19 fears, the demand for oil has been impacted even more and further drive oil prices to nosedive:

Looking at our local logistics, there are 4000 arrival flights in KUL a week, and there are at least 2 cars in an average Malaysian home that are all suddenly grounded, not consuming oil.

Transportation is one of the biggest global oil consumers:

This whole series of events is a double whammy for the Oil & Gas industry: getting hit on both ends, oversupply and low demand.

Exporting oil contributes to about 15% of the Malaysian Government revenue. So low oil prices will take its toll on our nation’s income and workforces in the Oil & Gas industry.

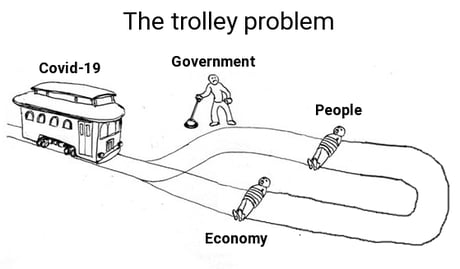

Death of the People Or Tank the Economy?

If we are lucky enough not to be infected with the virus, we will most likely be affected financially.

Saving Lives: Executing the MCO will help to break the chain of the Covid-19 infections at the cost of a battered economy.

Saving Businesses: On the other side of the coin, saving the economy by not implementing the MCO will risk infecting and killing a lot of citizens.

Europe is getting hit hard. They’ve probably underestimated the seriousness of this virus. Italy’s death toll exceeds 10,000 people because they were late in implementing their MCO.

The Malaysian government is on the right track. With our relatively low mortality rate of only 27 people so far from the virus, the MCO will hopefully break the virus chain over time.

Now we got the spread of virus somewhat in control, let’s see what financial bandage the Malaysian government is pulling out from its First Aid Kit to mend the nations battered economical wounds:

Government Induced Economy Stimulus

The Malaysian government realizes the social and economical impact of the MCO & Covid-19 to the Malaysian people. Which is why they were quick to announce corrective economical policies as early as March 23.

Here’s a summary in chronological order:

EPF Withdrawal

While the government is cooking up a stimulus package, on March 23rd, the government allowed its citizens to withdraw money from their KWSP 2 retirement fund for those who need the extra cash in these hard times.

This special withdrawal program is named I-Lestari. The gist:

- Max withdrawal of RM500 a month

- Max for 12 months

This policy had mixed reactions from the public because if you do withdraw money from your EPF 2, you’re using up your future retirement money.

My personal view on this is to only withdraw money from your retirement funds if you absolutely need the extra cash to stay afloat.

Moratorium

This topic deserves an entire post on its own.

When people lose their income over this pandemic, they won’t be able to pay their monthly loan payments, which is usually our biggest financial commitments.

Bank Negara knows this and initiated an automatic 6 months loan deferment package (moratorium) to all borrowers in Malaysia.

Anybody who has banking loans regulated by BNM automatically skip paying their loans for 6 months from 1 April 2020:

- Housing Loans

- Car Loans

Depending on your type of loan, you might be charged interest during the moratorium. Meaning, after the moratorium, your monthly payments might increase.

Make sure you check with your respective banks on how it fully works on your specific situation. Read Bank Negara’s official press release & FAQ sheet.

This is a great move from Bank Negara. The idea is to prevent a lot of people from going bankrupt and running their credit scores during this global pandemic.

This moratorium will also help those who never had a chance to save up for their rainy day fund and have a financial breather.

Rakyat Prihatin Stimulus Package 2020

This is basically a cash handout focusing to benefit individuals in the B40 & M40 group.

The total amount of money being handed out is RM 250 billion.

Links: Official portal & Press release.

This package also has mixed views because as far as we all know, before the Covid-19 pandemic, our country was hit hard with a slumping economy and the notorious 1MDB scandal.

All of a sudden with this new backdoor government, they’re handing RM250 billion out to the public.

Some people might think this is a political move to buy citizen’s trust, but politics asides, an injection of purchasing power to each individual will definitely help to jumpstart a stalling economy.

Other countries are also doing the same Economical Stimuli in their own currencies.

We have to be vigilant with the origins of this money. It could be our own money or our own future money. Nothing in life is truly free.

What’s in it for you?

The Malaysian government is doing an excellent job restricting the citizen’s movement and further spreading the virus around with the MCO edict.

You can do your part by staying at home and not help to spread the virus.

The Economic Stimulus and Moratorium is really helping a lot of Malaysians in this time of need. But hopefully, we fully understand the moratorium clauses and able to stand back on our feet once all of this blows over.

We are indeed heading straight into a worldwide recession and only recover in 2021, maybe. It’ll be smart for us to prepare for the worst. Be very frugal with spending. Nobody knows how long this MCO will be enforced to really break the chain of Covid-19.

In the meantime, companies will start laying people off, including big corporations and governments. Times will be tough.

If you never had a chance to build up your emergency fund before, take this Moratorium & Economic Stimulus package as an opportunity to save up.

Despite the grim reality, we need to keep our chin up and make the best of the situation. When was the last time you really had a chance to stay at home with your family this much?

Stay safe at home and this might be a wake-up call for all of us to move our income sources online in the case if this ever happens again in the future.

![[Robo-Advisors]: I Put RM1,000 Each into StashAway & Wahed Invest](https://helmihasan.com/wp-content/uploads/2020/06/Untitled-1-768x512.jpg)