Stop Getting Ripped Off when You Travel! Wise Card Review

The Wise Card is a revolutionary feature that I think all travellers & Digital Nomads need so you can spend money like a local, wherever you go!

- Stop getting ripped off by your bank every time you swipe your card abroad.

- Know exactly how much you’re paying each time you swipe your Wise card to buy something abroad.

- Know exactly how much you’re paying for currency exchanges without sneaky charges or fees.

- Withdraw foreign currency at the local ATM with minimal fees.

If you travel a lot or are a Digital Nomad, getting a Wise Card is a no-brainer.

If you want to save money with international money transfers with transparent & fair pricing, check out how to transfer money abroad using Wise.

What is Wise?

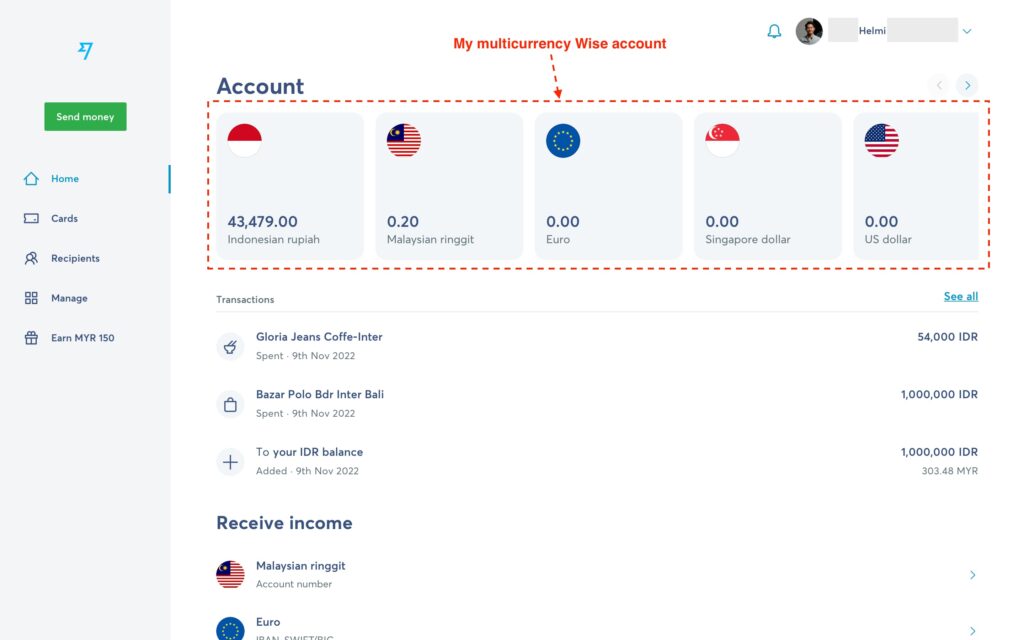

Let’s start with the Wise multicurrency account.

Once you register a Wise account, you can send & receive money in different currencies with transparent & competitive pricing.

You can think of it as an online money exchanger.

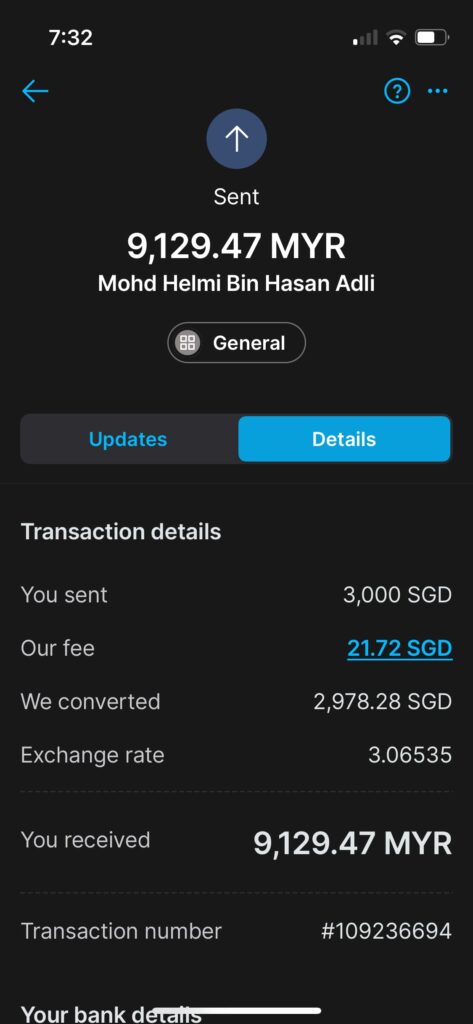

Here’s an example of a money transfer that I did where I sent MYR from SGD:

I particularly liked that:

- The exchange rate was very close to what Google showed me.

- Very transparent fees (SGD 21.72).

- I know exactly how much I will receive in MYR.

- I got the money within a few minutes.

Now let’s see how the Wise Card comes into the picture:

What is the Wise Card?

The Wise card is a cool-looking debit Visa card that is linked to your multicurrency Wise account.

It is an additional feature that you can request via the app (more on this later) & the card will be delivered to your home.

The Wise Card can help you save money every time you travel & spend abroad. Let’s see how:

How Does the Wise Card Work?

Here’s the breakdown:

- Buy currency that you want to spend in your Wise multicurrency account.

- Use the Wise Card to purchase items in the currency of your choice.

- Money will automatically be deducted from the relevant multicurrency account.

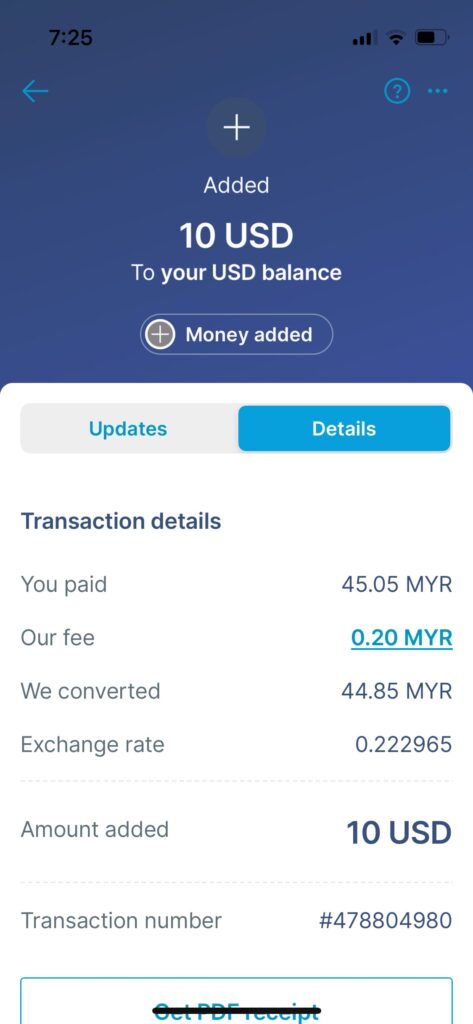

In the example below, I want to pay a USD 9.20 online subscription.

Since the Wise Card is a debit card, I need to have some USD in my multicurrency account.

I bought USD 10 using Malaysian Ringgit (MYR) & below are the fees during that time:

I then proceed to pay for the subscription using my Wise Card.

The Wise card will automatically deduct USD from my USD account.

Other examples:

- If you travel to Indonesia & use your Wise card there, it will deduct money from your IDR account.

- If you travel to Singapore & use your Wise card there, it will deduct money from your SGD account.

- If you travel to Europe & use your Wise card there, it will deduct money from your EUR account.

The Wise Card Fees

| Item | Fee |

| Ordering & replacing your Wise Card | RM 13.70 |

| Currency exchange rate | Varies depending on the currency & date. |

| ATM withdrawals | Free for 2 withdrawals in a month not exceeding RM 1,000. After which, you will be charged RM 5 + 1.75% |

How the Wise Card Saved me Money in Bali, Indonesia

As documented in my @millennialdadmy TikTok channel, I’ve recently gone on a family vacation in Bali, Indonesia where I get to use the Wise Card almost exclusively throughout our vacation.

@millennial_dadmy Saya pergi Bali, Indonesia & belanja semua benda pakai Wise Card. Dapat jimat banyak gila duit. Dari kluakan cash dekat ATM & juga tap kredit card dekat restaurant. Semua saya pakai Wise. Link utk apply ada di bio. #wisecard #wise #travelwithbaby #balibaby ♬ Paper Birds – Jordan Halpern Schwartz

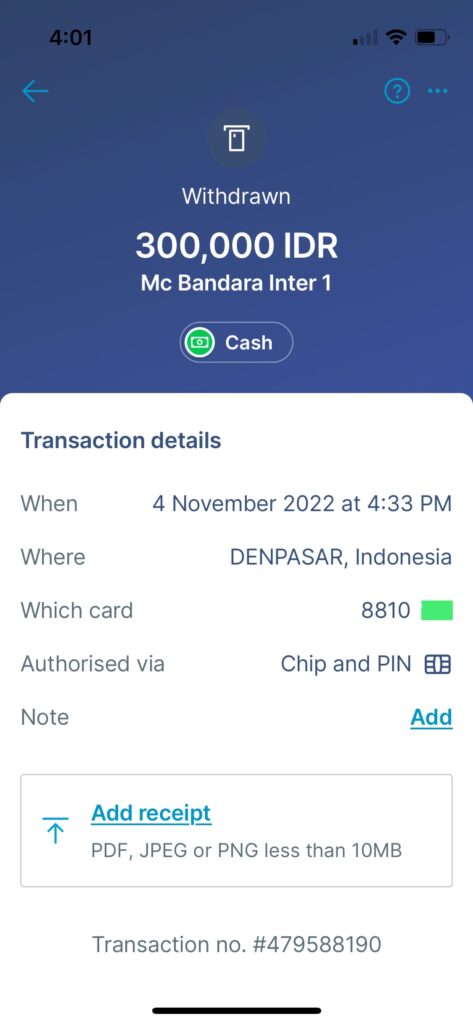

The first thing I did when I arrived at the Bali airport & cleared immigration & luggage collection was to withdraw some local IDR money to be kept for petty cash emergencies.

Then every time we spent money at restaurants or buying stuff from shops, I was charged exactly what is shown on the bill:

The statement is shown immediately on the app & the amount tallies with the receipt, so I know there are no weird, hidden fees:

The cool thing is that the Wise app can automatically categorize my spending.

This was helpful as I can keep track of our vacation spending.

Pros & Cons of Using the Wise Card

| Pros | Cons | |

| Fees | Fair transparent pricing | – |

| App UI/UX | I really like the user-friendly app | – |

| Beginner friendly | – | Somehow, it is confusing for some beginners |

| Jars (savings) | – | There is a ‘jar’ function that is akin to a savings account with no interest. You can’t spend money if it is in your jar function. |

The pros outweigh the cons. However, I went to Bali with another couple & they also had a Wise card.

Somehow, they did not 100% get how the Wise Card works & which requires me to explain it to them to get them up & running with the card & app.

If I weren’t there to explain it to them, I’d reckon they’d stop using their Wise Card.

How to Get your Wise Card

I hope this article has convinced you how important it is to have a Wise multicurrency account together with the Wise Card.

So, if you wanted one too, here’s the step-by-step of what you need to do:

- Register a Wise account here.

- Log into your Wise account online or via the app & apply for your Wise Card.

- Wait for the Wise card to be delivered.

- Once you have your Wise Card, follow the instructions to activate the card.

- You can start using your Wise card!

![[Simplified]: How to Start Managing Money – Step by Step](https://helmihasan.com/wp-content/uploads/2020/06/Copy-of-Net-Worth_-768x512.jpg)