Check Your Malaysian Credit Score for FREE With CCRIS & CTOS

Knowing your credit score is important to see how good you are in the eyes of a credit lender. In this article, I’ll explain what is a credit score report, why you should care in the first place, and how you can get them online for free.

I’ve requested my credit score reports from CCRIS & CTOS, and in this article, I will share with you my experience:

What is a Credit Score Report & Why Should You Care?

A credit score report shows how good you are at paying back all of your loans & bills on time. When you want to apply for a loan or credit somewhere, the lender will do a background check to see if you are credit-worthy (bank lingo for someone that manages their money well).

Lenders will estimate how risky you are as a borrower based on your credit score report. If your score is high, it reassures the lender that you’ll most likely pay back the money they lent to you on time, and in contrast, if your score is low, it shows that you have a tendency to skip payments and a hassle for the lender to get paid.

Someone with a low credit score might still get a bank loan, but the bank will charge a higher interest to accommodate the risk that they’re taking of not getting paid on time.

Because of that, it’s important for each of us to know our credit score report at least once a year to make sure that we are always credit-worthy & to see if there are any signs of identity theft (someone can steal your ID to apply for stuff without your consent).

How Can You Check Your Credit Score For Free?

In Malaysia, there are 2 ways you can get your credit report score:

Here are the main differences between the 2 without getting too technical:

| CCRIS | CTOS | |

| Report from | Bank Negara Malaysia (Central Bank) | CTOS, a private credit report agency |

| Fee | Free | Free (this is fine for most people) RM 24+ per detailed report |

| User friendly-ness | Quite of a hassle, a lot of paperwork to do in order to get the report, typical how Malaysian gov system works | Easy & fast. Register with your IC & do a video selfie |

Most lenders will check both of the reports above to size you up as a borrower. So I checked my credit report score on both CCRIS & CTOS to see what’s the difference.

It would be best to check your credit score on both of these platforms. Let’s start with CCRIS from Bank Negara:

How to Check CCRIS With Bank Negara

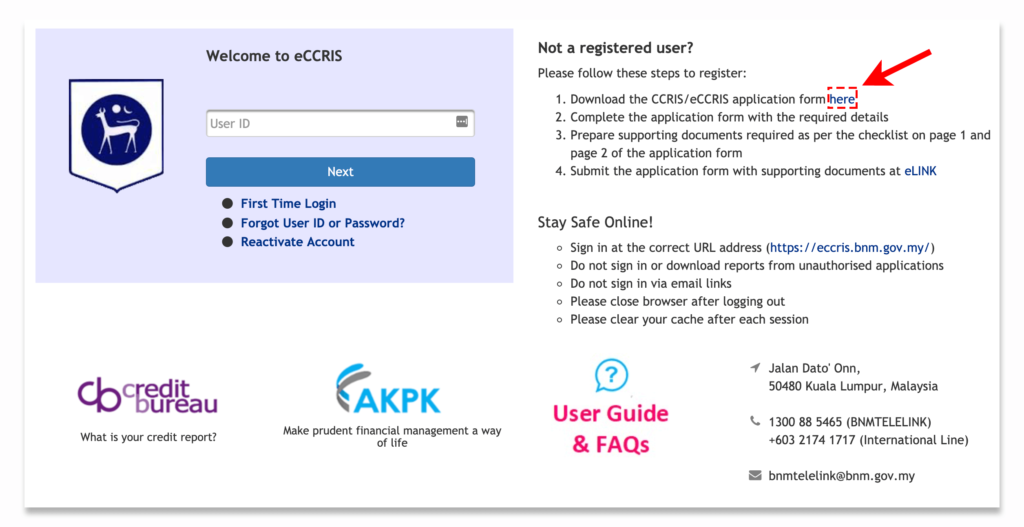

Go to Bank Negara’s website and follow their instructions to register as a user. The first order of business is to download their form and start filling it up:

Submit the form as instructed and wait for bnm to email back your score. This can take a few days.

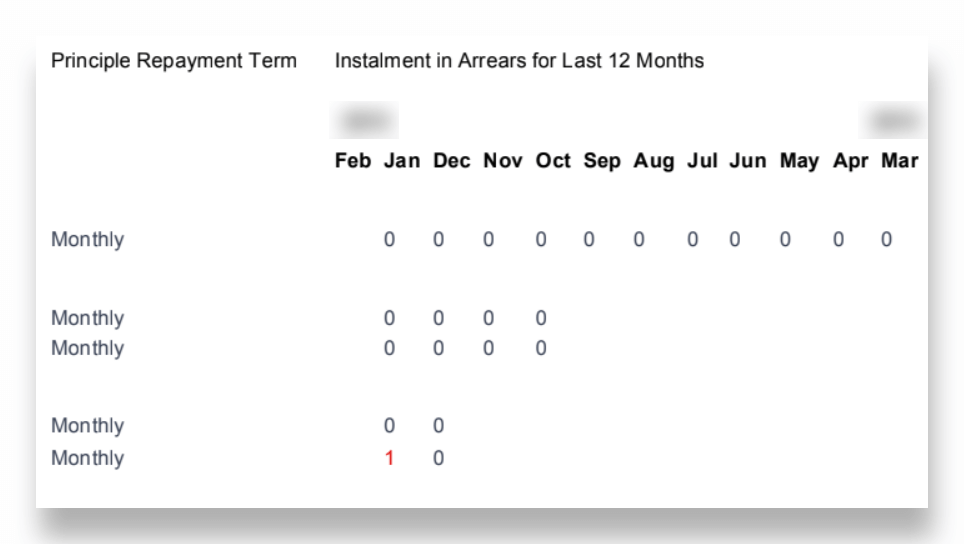

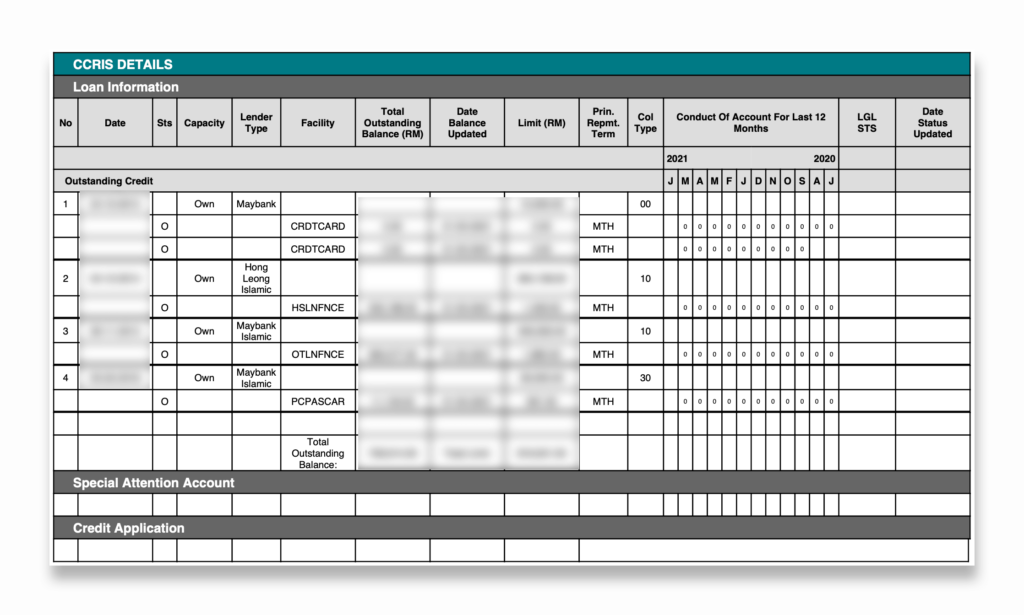

Once you get your CCRIS score, you want to take a look at the installment repayment table. Generally, you want most of the numbers to be ‘0’. If there’s any number besides 0, it will be marked red, indicating that you’ve been late on a payment:

How to Check Your CTOS Score for FREE

Unlike CCRIS, checking your credit score with CTOS is much simpler and faster. All you have to do is register a free account with CTOS here & follow their instructions.

You want your credit score to be above ‘Good’ to be considered a good paymaster, and this is visible in the free version of CTOS:

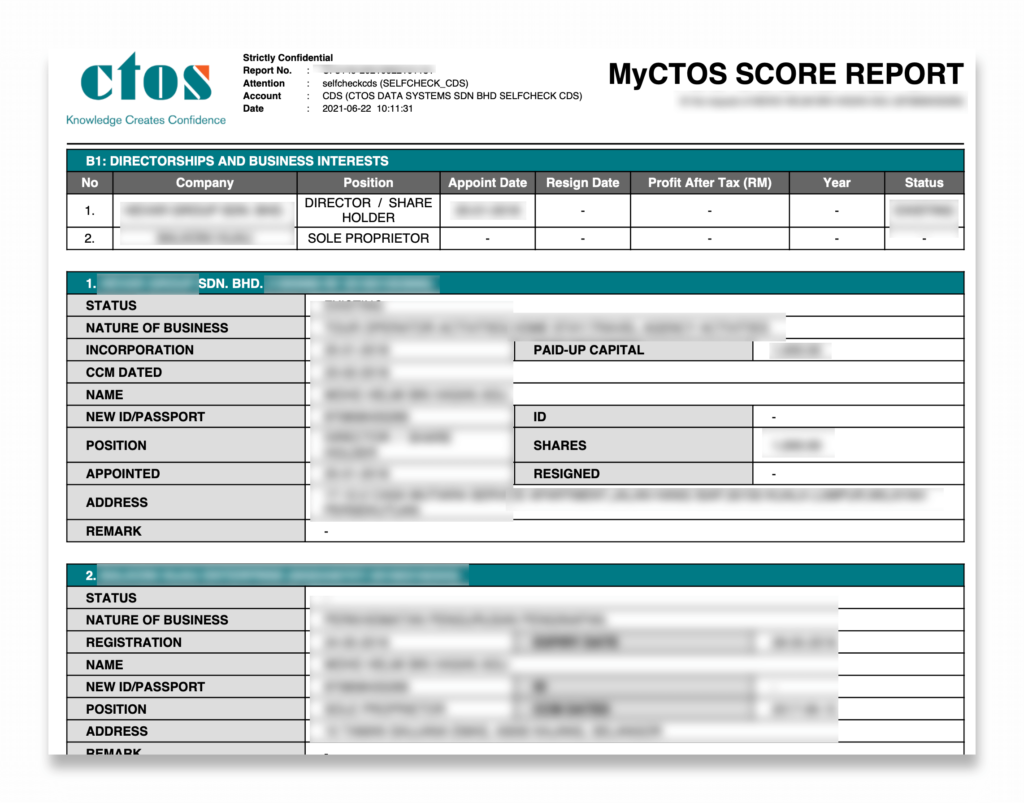

If you clicked on the ‘View last report’ button, you’ll get a bit more detail of your info, including if you have any records setting up a business. Here they managed to capture both of the businesses that I’ve registered before:

Nice! The free version is enough for most people to have a rough idea where they are credit-wise. Click the button below to check your credit score:

Where Does CTOS Get The Information From?

According to CTOS’s FAQ site, they collect everyone’s data from credit data that is available publicly. You can see that list here.

Sample of Paid CTOS Report

If you want to know more details in your CTOS report, you can pay for the latest report. It cost me RM 24 at the time of me writing this blog post.

One of the first thing that you’ll see is the detailed breakdown of any business registration or directorships under your name:

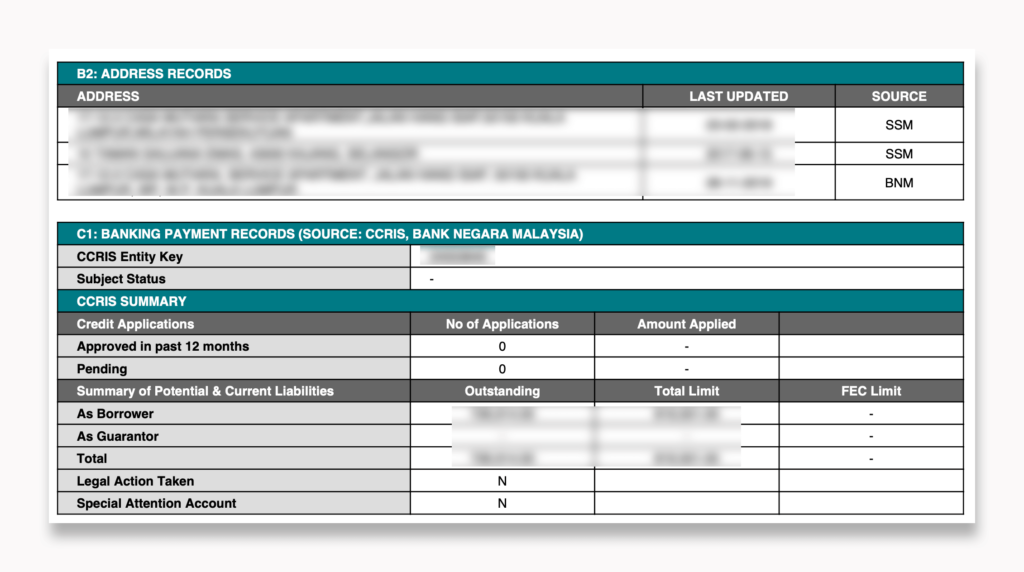

You’ll see the record of address changes and any credit card application status:

The paid CTOS contains the detailed breakdown of loan repayment history just like in CCRIS:

Check Your CCRIS & CTOS Report for FREE

It’s best to check your credit report on both CCRIS & CTOS website. Click on the button below to start checking your credit report:

![[Personal Update]: 8 Months in – Wahed Invest Vs Stashaway – RM 10,000 Portfolio](https://helmihasan.com/wp-content/uploads/2021/02/Untitled-11-768x512.jpg)

One Comment