[Simplified]: How to Start Managing Money – Step by Step

So you want to start managing your finances? Hey, Welcome to adulthood!

But wait; Budgeting? Net Worth? Cash Flow? Liabilities? Assets? 50-30-20 Rule? What do these mean, and where to start?

Over the years, through trial and error, I made my own Google Spreadsheet to figure out how to manage my personal finances and thought I’d share it with my blog readers.

By downloading my template and going through this article and video, you’ll get to know how to:

- Understand the Fundamentals of Personal Finance.

- Calculate Your Net Worth.

- Manage Your Monthly Cash Flow.

- Record Your Daily Transactions with an App.

- Download my Template with Video Guide.

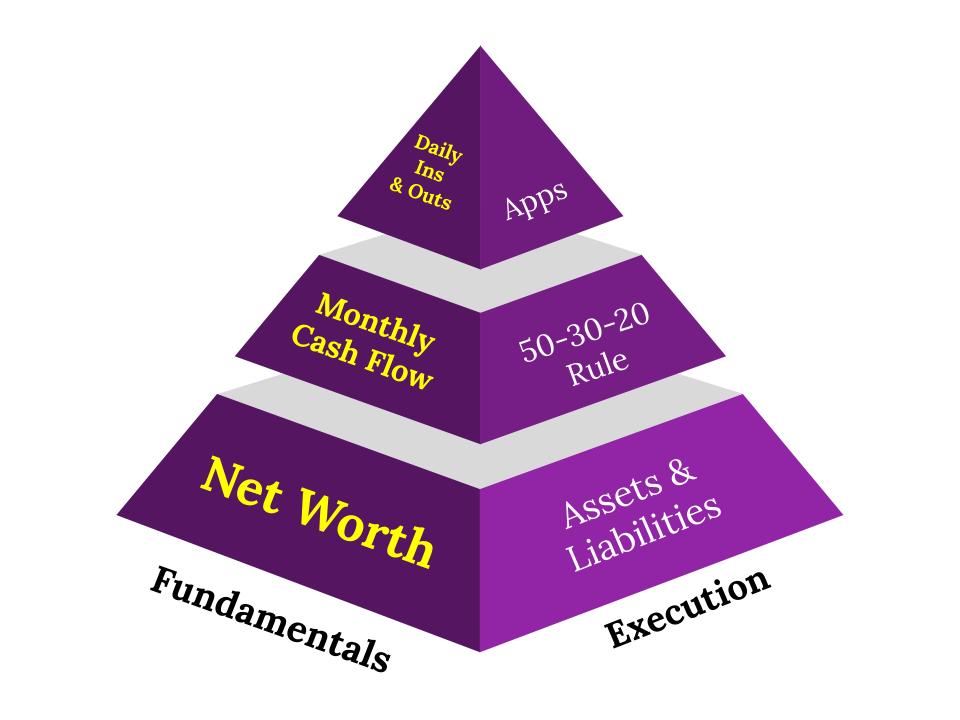

Let’s start with an overview of the fundamentals of Personal Finance with the aid of the diagram below:

[Simplified]: Fundamentals of Personal Finance

You’ll start by looking at your finances from the outside in (zoomed out to zoomed in for you photographers out there):

STEP 1: Start with a strong base: Knowing your Net Worth.

STEP 2: Taking charge of your Monthly Cash Flow with the 50-30-20 rule.

STEP 3: Tracking your Daily Transactions using an app.

Let’s start at the base of the pyramid without going into too much detail:

Calculating Your Net Worth

The first order of business is to calculate your Net Worth to get a bird’s eye view of all of your assets and liabilities. From here, you can see the financial mess that you got yourself into.

Your net worth is the difference of your total Assets minus your Liabilities:

For more details about calculating your net worth, click on my article on How to Calculate Your Net Worth For Millennials [Guide with Template].

After you know where you are in the grand scheme of things, the next step is to zoom in a little and manage your monthly cash flow:

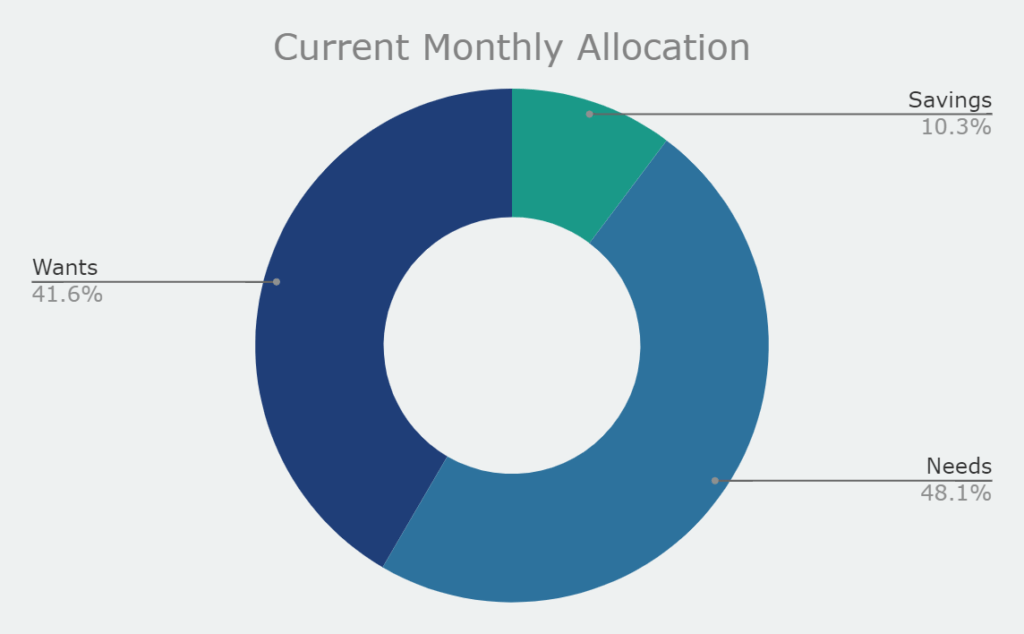

Managing Your Monthly Cash Flow

After mandatory deductions (income tax, EPF, and SOCSO), I’ll be using the 50-30-20 rule as a rule of thumb to manage my monthly take-home pay.

You don’t have to follow the rule exactly, and you can tweak it around to suit your unique situation. But this rule will apply to most people, especially if you don’t know where to start.

Here’s how to apply the 50-30-20 rule to your take-home-pay:

| 50% on your needs | 30% on your wants | 20% on forced savings |

| Mortgage Home Utilities Insurance Groceries | Car Eating out Investments Subscriptions Leisure activities | Emergency fund Cash savings |

You’ll notice while filling in your monthly budget, is that you might not know the exact amount for some expenses like your car and eating out. It’s OK to estimate at this point because, in the next section, you’ll be using an app to track your expenses more accurately.

Tracking Daily Expenses with an Apps

The last thing to take care of is your daily nitty gritty expenses. This could get tedious, but with a help from an app, it could make this mundane task easier and sometimes enjoyable.

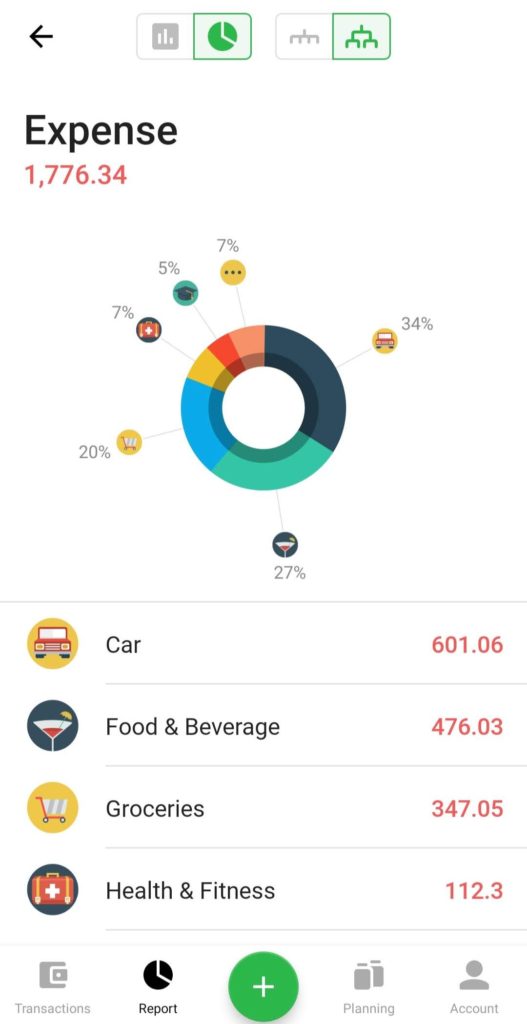

I use Money Lover App to record my daily transactions:

You don’t have to be too anal about tracking every single thing. For me, I’m only interested to know how much I spend on my wants:

- Luxury groceries.

- Eating out.

- Treating the GF & friends.

- Car expenditures: petrol & parking

- Clothing shopping.

Now you know the overview of how to tackle personal finance, you can download my free template below:

Download My Free Template

Fill in the info below to get my template delivered to your email:

Remember to save a copy for yourself so you can edit it. Next, look at the video below on a step-by-step guide on how to use my template: