Updated (1st May): Moratorium Explained for Normal Malaysians

With the Covid-19 global pandemic worsening, the government enforced the Movement Control Order (MCO) on 18th March 2020.

All non-essential businesses are required to close shop, and everyone is forced to stay at home to minimize human physical contact.

Unfortunately, not all jobs can be done online from home (work from home). Some people lose their income if they can’t physically work.

Your spending is someone else’s income.

When people stop spending, the economy stalls.

To ease the financial burden of loan borrowers during this tough economic time, Bank Negara Malaysia (BNM) has introduced the Moratorium order to loan borrowers for six months.

In this article, I’ll be focussing on the two biggest financial commitments for the average Malaysian:

- Mortgage repayments

- Car loan repayments

What I won’t be covering are:

- Credit card debt

- Personal Loans

UPDATE: I will cover the moratorium update on hire purchase (car) loans announced on 30 April 2020.

Let’s start with defining the moratorium:

What is a Loan Moratorium?

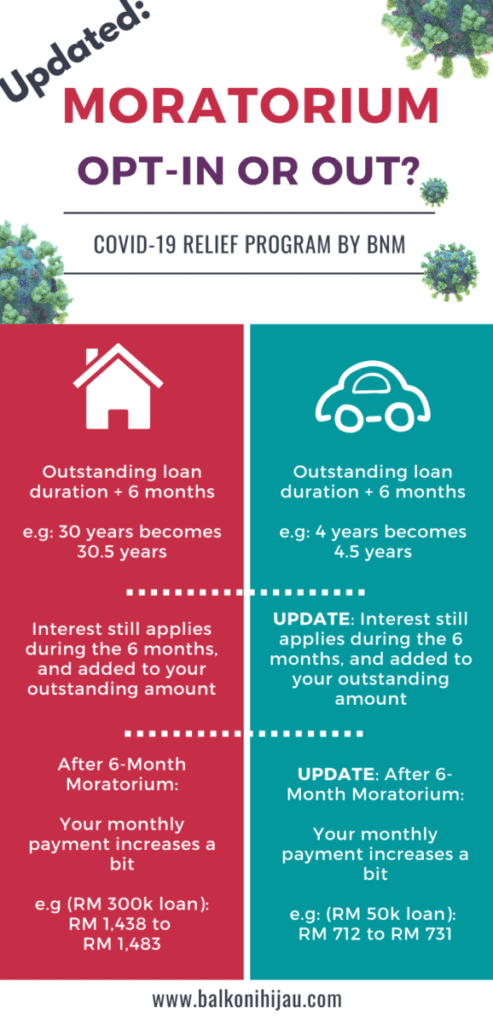

In plain English, all monthly mortgages and car loan repayments are not required from 1 April 2020 for six months.

You’ll continue your monthly loan repayments as normal starting 1 October 2020, where your loan duration will be extended for 6 months & monthly repayments will increase slightly.

The moratorium is automatically applied to mortgages, but need to apply for hire purchases (car loans).

But My Loans Are Auto Debited. Does it Stop for 6 Months?

For Mortgages: During the 6-month moratorium, the ‘standing/auto-debit instruction’ will stop, unless if you opt-out (we’ll cover how to opt-out later).

In other words, your bank will stop automatically deduct money from your bank account for 6 months.

For Car Loans: A new update of BNM policy is that there will be a need to notify your bank that you want to Opt-In. Updated BNM FAQ sheet, point #1.

Will This Mess Up My CCRIS Score?

No. Your CCRIS score from March 2020 will be carried unchanged during the 6 month Moratorium period. Source: BNM Faq sheet (point #8).

Your CCRIS (Central Credit Reference Information System) is your loan repayment history kept by BNM for all borrowers.

What’s the Catch?

There’s always a catch to everything.

During the 6 month moratorium, the interest of the loan still applies and will be added to your outstanding loan amount.

After the 6 months moratorium, the bank’s profit will be recalculated based on your new outstanding amount (which is now increased compared to before the moratorium).

So by the end of the 6 months moratorium:

- Your outstanding mortgage tenure will be extended for 6 months (30 years becomes 30.5 years).

- Your monthly mortgage and car loan repayment will increase ever so slightly to compensate for the interest accumulated over the 6 month moratorium period.

Why Does Your Monthly Mortgage Payment Increase After the Moratorium?

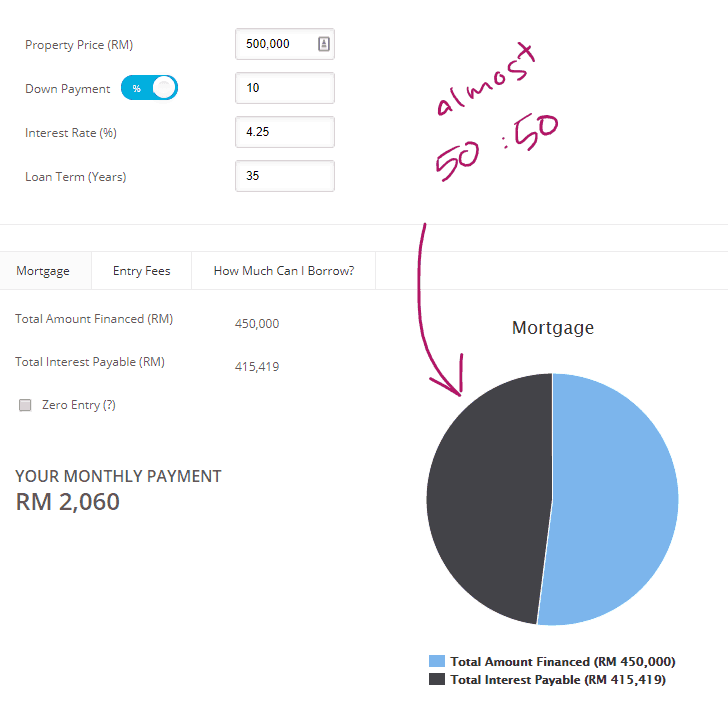

A lot of us (including myself) don’t know how mortgages work and have no clue how much we’re paying in interest. A little research shocked me:

If you borrow RM 450,000 to buy a house, by the end of the 35 years, you’ll be paying back RM 865,419 in total, almost double what you’ve initially borrowed.

That RM 2,000 monthly repayment that you’re paying each month, about half of that (~RM 1,000) goes to interest:

(I am simplifying the interest calculation to make this easier to understand).

That RM 1,000 interest each month for six months (RM 1,000 x 6 = RM 6,000) is added to your outstanding loan amount, and the bank’s profits will be recalculated.

The Moratorium will help Malaysian borrowers save up extra cash in hard times of this pandemic and job losses, at the expense of you having to pay more later and for longer.

UPDATED: Moratorium for Car Loans

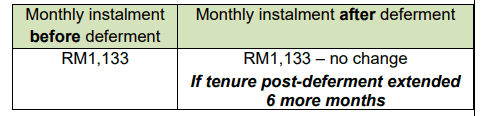

Old Moratorium for Car Hire Purchase

Initially, BNM FAQ sheet mentioned that for car loans, the interest is fixed. No interest will be added to your outstanding loan amount and after the six-month moratorium, your monthly repayment for your car remains the same:

There are no financial repercussions to opt-in for the moratorium for car loans. Only your loan tenure increases from 5 years to 5.5 years.

The moratorium is a very attractive package for car owners with outstanding loans. (It is not so attractive anymore):

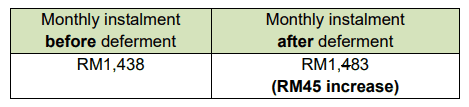

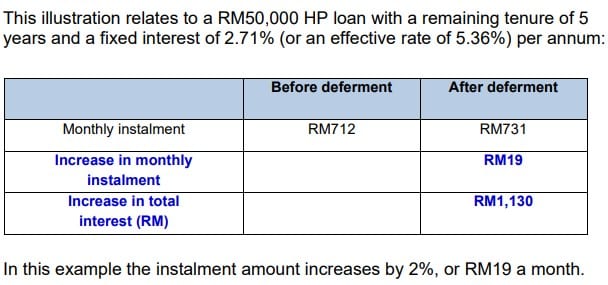

Updated Car Loan Moratorium, 1st May 2020

The interest for your car loan repayments during the 6-month moratorium is still chargeable, and your monthly repayment will increase. Sample calculation:

Should You Opt-Out of the Moratorium?

This will depend on your situation and how affected your income is during this Covid-19 pandemic & MCO.

There are 4 main categories that you might fall into:

| Income Source | Do You Have Minimum 6 Months Savings? | Moratorium for Mortgage? | Moratorium for Car Loan? | |

| 1 | Unaffected, can work from home | Yes | Don’t be foolish, you’re a financial star. Opt-Out & pay your loans like normal. | Opt-Out |

| 2 | Unaffected, can work from home | No | Opt-In if you think you’ll never able to save up 6 months reserves in a normal situation. Opt-Out if you don’t want to pay more every month after the moratorium ends. | Opt-In if you really need to use the extra cash. Otherwise, Opt-out |

| 3 | Affected, no job or no sales | Yes | Don’t Opt-out, if you’re comfortable to use up your savings to pay your mortgages manually. Opt-In if you don’t want to dip into your savings | Opt-In if you’re OK with the increase in monthly repayments |

| 4 | Affected, no job or no sales | No | Take it! Prepare for the worst scenario. | Opt-In if it’s an emergency |

In an ideal financial situation, you would not want to opt-in the moratorium, because you’ll have to pay more in the end.

Be honest with yourself on where you stand financially during this pandemic & MCO, and make the smartest decision that works best for you and your unique situation.

Why & How to Opt-Out?

If you are financially healthy and with a bulletproof job and source of income, you’d want to opt-out of the moratorium.

You can opt-out by going to your bank’s website and simply filling out an online form. Here’s Maybank’s form, it’s on their front page:

What I am Personally Doing For My Scenario

My income is also severely affected by the Covid-19 pandemic & the MCO.

I personally am in category #3 from the table above. At the moment, here are my commitments:

- Mortgage for my own apartment that I stay in

- Mortgage for an apartment that I’ve rented out

- Car loan

- I have no credit card debt

Typically, I’d rent out my apartment on Airbnb for a few days in a month to help cover my mortgage. This is clearly not happening during the MCO.

My other property has been rented out on a 2-year lease, and I don’t think the tenant’s income is effected as she is a lecturer.

My current cash flow: My cashflow is in a negative state at the moment, and I am bleeding my savings out to stay afloat.

I was lucky enough to exit from a previous business venture right before the Covid-19 become a pandemic that I have a sizeable lump sum of money.

I have locked in the money into a Fixed Deposit account for extra safekeeping.

I plan to use this money to manually pay off all of my loans, as usual during the moratorium period.

In the meantime, traditional jobs and businesses have collapsed. I am aggressively working on finding my way to make money online.

Wrapping the Moratorium Up

A lot of Malaysians will be affected financially by the Covid-19 pandemic & the extended MCO.

The government is helping us with a once in a lifetime moratorium order to help us with our cash flow problems.

But make sure you understand both sides of the coin and hope this article has been helpful.

Useful Resources:

Bank Negara Malaysia’s Moratorium FAQ sheet.

Bank Negara Malaysia’s Moratorium for Interest on Hire Purchase FAQ.

Maybank’s Moratorium FAQ sheet.

Related Articles:

Covid-19, Movement Control Order (MCO) & the Effects on Our Economy

Lay Offs During MCO: Why Businesses Are Forced To Do It