How to Be Alert & Dispute a Fraudulent Credit Card Transaction

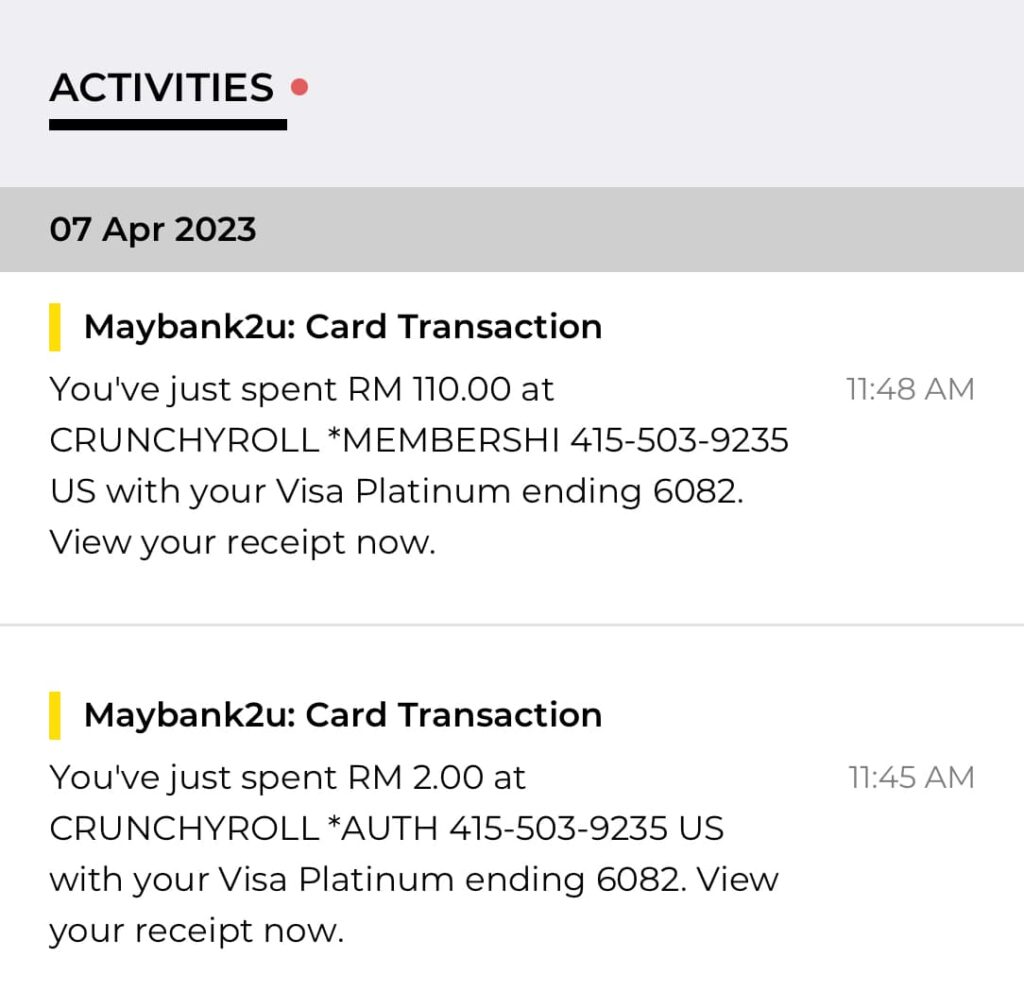

The other day, I was attending a course, and all of a sudden, I received a notification on my MAE app (an app for Maybank customers).

I was on a physical course. Clearly, it wasn’t me.

So when I reached home, I called up the bank. This article & video above will help you determine what to do if you are in a similar situation.

Google the contact number for your bank. In this article, I’ll show how to do it for Maybank credit card users.

I got on a call with Maybank’s fraud department (there is no waiting online).

Here’s what I learned about our telephone conversation with the Maybank fraud executive:

How Does Credit Card Fraud Happen?

The credit card information on my computer or smartphone is compromised.

It could be a malware application that is designed specifically to steal sensitive information like credit card info.

The rep told me that this incident can be due to the following reasons:

- I gave my credit card info to someone.

- A family member used my card to purchase.

- A malware app I recently installed stole my card info.

How to Minimize Your Risk

The rep told me to install an anti-malware or anti-virus on my phone & computer to help periodically check for suspicious files.

It’s a good habit to periodically check your credit card statements. Either on the app or on your computer.

Turning on the notification for each transaction will be super helpful. That’s how I noticed this fraudulent activity on my card.

For Maybank users, the M2U app could not notify you of each transaction. You need to use the MAE app & link it to your M2U app.

Step-by-Step to Dispute a Fraudulent Charge

Go to maybank2u.com.my.

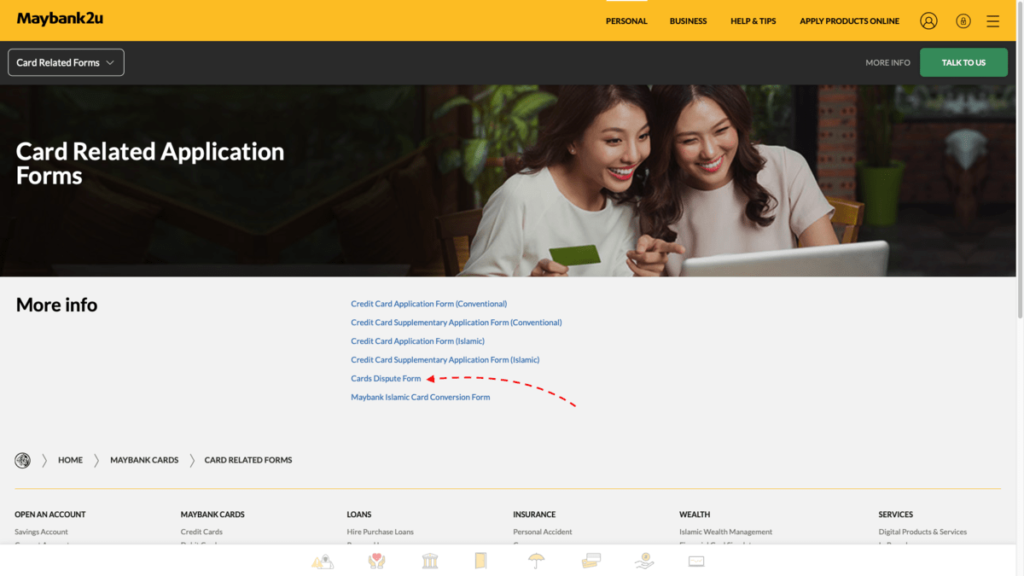

Scroll all the way to the bottom, under the column ‘Maybank Cards,’ & click on ‘Card Related Forms.‘

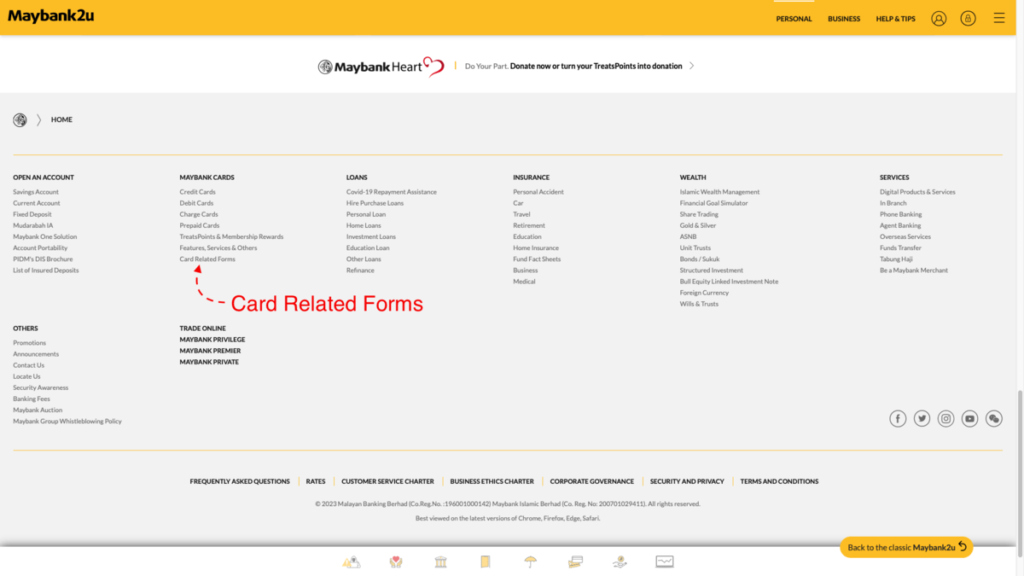

Click on the ‘Card Dispute Form.’

Good luck!

![[Survey]: Average Malay Wedding Cost Breakdown – Guide for Couples](https://helmihasan.com/wp-content/uploads/2022/05/WEdding-cost-survey-768x512.jpg)

![[Milestone]: Balkoni Hijau is Listed as Top 20 Personal Finance Blog in Malaysia!](https://helmihasan.com/wp-content/uploads/2021/07/TOP-20-768x512.jpg)

One Comment