Cost of Living in Kuala Lumpur for a Single Millennial in 2020

If you come into Malaysia as a tourist, your first impression of Kuala Lumpur might be that it’s a modern city and the residents seem to be keeping up with western trends and standards.

If you simply look around, a lot of people have $1,000 iPhones and make frequent visits to hipster cafes and nice restaurants as proven in their Instagram feeds.

Apart from that, luxury automobiles on the roads are almost on par if not better than in the modern west.

So looks like Malaysians are doing quite well for themselves.

Or are they? Do they really make decent money? Or is this all smoke and mirrors in the age of fake it till you make it?

When I Used to Work in Singapore

When I used to work in Singapore, I was making pretty decent money over there. That being said, with a personal housing budget of SGD 1,000 a month (that’s ~RM3,000 in 2019), I can only afford to rent a room in a shared flat in Singapore with that budget.

But when I travel out of Singapore, I do feel that my purchasing power was quite strong. At the time, SGD 1 was about MYR 2.3 back in 2013.

So when I went back to Kuala Lumpur over the weekends and catch up with my Malaysian friends at one of the trendy hipster cafes, I was quite shocked by the prices of the hipster menus.

What do you typically order at a hipster cafe with friends on a weekend brunch? I’m guessing it will look something like this:

1 brunch order (typically overpriced eggs, sausage, and avocado toast served on a fancy plate) at around RM30 per dish and at least 1 cafe or latte to wash it all down which is around RM12 a cup.

We all went dutch and my portion came close to RM50.

Even with my strong Singapore Dollar purchasing power, I was like “damn! RM50 just to have brunch? Malaysians must be rich!”. Even I felt the pinch.

But when I looked around the table to see everyone’s facial reaction to the bill, not one of them made any remark about the price and quite easily whipped out their respective credit cards or cash.

I was quite confused, either they all made a lot of money, or they don’t but have blindly accepted their fate.

After brunch, we took pictures on their fancy new iPhones and all hugged goodbye and parted ways. I couldn’t help but notice the cars that they drove to get here.

A Little Online Research for the Average Malaysian Salary

I obviously didn’t blatantly ask my friends “hey how much do you guys make over here?” that sounds quite rude. But the curiosity was burning inside of me. They all seem to do very well!

If only I know how much they’re making, I could compare it with my Singapore salary. If after taxes and expenses, they might be taking home more than me, hence why they can afford the millennial lifestyle. If that’s the case, I would rather live and work in Malaysia!

So I went home and Googled the average salary in Malaysia. I was very skeptical about the accuracy of these reports. But here’s what I found out anyway:

The Malaysian gov says: The average is around RM 3,000 a month.

Really? That’s it? With the ever-increasing housing cost, iPhones and expensive cars, and the modern lifestyle that I see Millenials partake in Kuala Lumpur, RM 3,000 is simply not enough.

That being said, I know several Malaysian friends who make above average:

- Oil & Gas Design Engineer makes RM 7,500 a month.

- An Oil & Gas Sales Engineer makes about RM 9,000 a month.

- Several doctors make around RM 6,000 a month.

But why the big difference between the gov data and what my friends are telling me?

- The statistic is the average of entire Malaysia including the rural areas which brings the average down.

- It could very be possible that the people I tend to hang out with when in Malaysia are in the T20 crowd.

Currency Exhange

If you’re planning to move into Malaysia and need to regularly transfer money abroad, I’d recommend Wise. I’ve been using them for years and they’re my go-to online remittance service.

How Much Does a Typical Malaysian Millennial Need to Support Their Lifestyle?

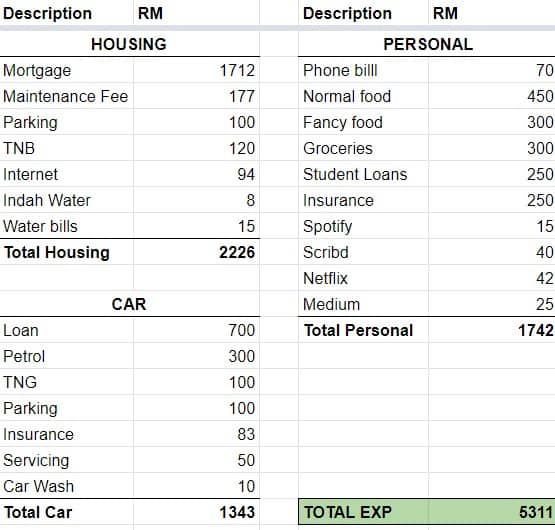

I made a personal budget for myself to know how much I need to make for a decent living in Kuala Lumpur.

So if I run a business, or want to get a job, at least I know what I need to aim to get to cover my personal expenses.

I know making a budget is tough and most of us will choose to ignore the fact that we spend more than we make.

Before we go on, a little background about myself:

As of today, I am 32 years old and unmarried. I have my own place and car. I do most cooking at home but have allocated a budget to eat out (normal RM12 food) a few times a week and also allocate in some fancy meal allowance as well.

So you might be able to relate to most of what I have to spend on a monthly basis. I think my lifestyle is quite average and I don’t have any expensive hobbies (as of now).

The only thing that I think might be a little eccentric to most Malaysian Millenial is that I am paying a full mortgage and living by myself. Whereas most unmarried Millenials will most likely live with their parents to save money.

Expenses Breakdown

As you can see, my expenses are typical and not at all flamboyant. It is concerning to see that the breakeven cost is RM 5,311. Pretty high and considering the average household income of around RM 3,000. This figure is alarming.

Housing

I bought a small studio for myself in the middle of the city. Space is small and really teaches me to live a minimalist lifestyle. In a way, it calibrated my brain to stop buying random garbage and bringing it home.

I am the type that hates driving in rush hour traffic. It drives me nuts. After living abroad in Singapore and Europe with fantastic public transport, it is my #1 priority to get a strategic place close to work and train station.

I could’ve saved money by renting just a room as I used to in Singapore. But at 32, this shared living space, shared toilet, fridge, and kitchen is not going to cut it for me.

Let’s say rent or mortgage is around RM 1,700, you must not forget that there are so many bills that come with the house (electricity, internet, service fee) that will easily bump up your housing expenses to beyond RM 2,000.

Housing is the most stressful expense to a typical independent Millenial not living with their parents.

The next largest housing expense will be your electricity bills. If you are the type that has a high TNB bill, you can read my article about how to lower your TNB bill.

Personal Car

A car would be most people’s second-largest expense. As I mentioned before, Malaysians are quite superficial with their cars. It’s like a status symbol and most of the time, car purchases are made with emotions rather than financial logic.

That being said, I bought a small financially smart car that fits my current purpose. I took up only a 5-year hire purchase tenure (thanks to high trade-in value from my previous car) that brings the monthly repayment to only RM680.

But again, let’s not forget all the expenses that come with maintaining the car like parking, servicing, car wash, tolls, that Ambi Pur, and petrol. This will bump up the car expense from RM 680 to RM 1,300+.

So imagine if you decide to buy a fancier car that costs you RM 1,500 a month. Once you add up all the running cost, your car expenses per month will easily be around RM 2,000 + a month.

I don’t know about you, but I’d rather use my money to get a decent place to stay rather than using it to pay for a depreciating car.

If you’re new to Malaysia, I would advise you to not get a car right away and live close to work. Make use of trains and GrabCar. This way, if you do the math, you’ll spend less than RM 1,300 a month.

Personal Expenses

My phone bill is advertised to be RM58 a month with unlimited calls, but the bill will always be around RM70+. A quick diagnose shows that there’s 2 reasons for the discrepancy:

- Despite marketed as unlimited calls, reading the fine print of the contract will show that not all calls are free. For instance, the 1 300 numbers (I think it’s for one of my banks) are subjected to charges. So keep an eye out for that.

- As I am running an Airbnb business, sometimes when my international guests get lost despite my clear directions, we often have to call one another. This brings my phone bill up from the advertised RM 58.

Food: I will try to cook at home as much as possible to save money. Cooking in bulk and freeze is the way to go. Plenty of YouTube videos on this if you have no idea how to cook.

I allocate a budget to eat out once a day for lunch at an average price of RM 12. This is a typical Malaysian side of the road restaurant. Nothing fancy, simple honest food.

From time to time, I also want to go out with friends or girlfriend to have something nice to eat. How I justify this, a decent meal at a restaurant is around RM70 per person and I allocate to eat something decent once a week.

If I really feel fancy and want to treat my gf, I can go somewhere that costs around RM 100 per person and I pick up the whole tab. This will knock off RM 200 from my fancy food budget, with RM100 left to spare for the month.

Groceries: I used to love Ruffles chips. Not only it makes me have a dad bod, but it’s also RM 12+ a pack! So I decided to cut off all junk food and my grocery bill is greatly lowered.

I purchase commodity items such as soap and detergent at Tesco but get fresh items like fruits and meat at Village Grocer.

Insurance: I’m not sure if I made the right decision to purchase investment-linked personal insurance at RM250 premium each month. But after a few years, I get cash bonuses amounting to around RM 6,000 I think.

I hate monthly occurring bills that murders my monthly cashflow so I contacted my insurance agent to use the bonus to repay my future premiums until the money runs out.

So instead of cashing the bonus out and buying stupid crap, in theory, I can skip paying my monthly premiums for the next couple of years which is neat.

Personal Subscriptions: Although the main theme of my life is to be financially smart and saving money bla bla… but I have to have a nice balance in life.

I love to listen to good indie music. So Spotify premium is a must for me. At RM15 a month, I think this price is totally acceptable.

I used to get one of those Android TV boxes that can stream illegal TV shows but due to their inconsistent underground nature, I got fed up and got myself the regular Netflix that costs me RM42 a month. Still cheaper than the Astro subscriptions our parents used to have which was around RM200 a month.

Online Reading: I love reading. Obviously reading physical books are the best but due to my small living space, I made myself get used to reading digital versions instead.

So at the moment, I have an ebook subscription (sribd.com) at USD 8.99 a month for unlimited ebooks. This is cheaper than me purchasing MYR 80 for a single book. Because I read a lot, the money saved pays for itself.

I am also considering to purchase another online subscription on Medium.com at USD 5 a month.

Paying for these recurring monthly expenses in USD when my bank charges me in MYR can result in horrible exchange rates. I wrote another blog post about how to save money purchasing foreign currency using E-Wallets.

Wrapping it All Up

Looking at how much Malaysians make statistically, with how much my group of friends makes and the financial breakdown that a Millenial needs to have a nice lifestyle here’s my conclusion:

- The average income does not cover the typical Malaysian Millenial lifestyle.

- The wage gap between income groups is huge.

- Either Millenials have a lot of side hustle businesses or jobs that they don’t declare and captured in the stats or

- Millennials get a lot of financial help from their parents or

- Maybe Millennials can barely afford their lifestyle, at the expense of having no savings.

- Millennials are living an outright financial lie.

![[Save on Coffee]: Should You Buy an Espresso Machine or a French Press?](https://helmihasan.com/wp-content/uploads/2021/06/Blog-1-768x512.png)